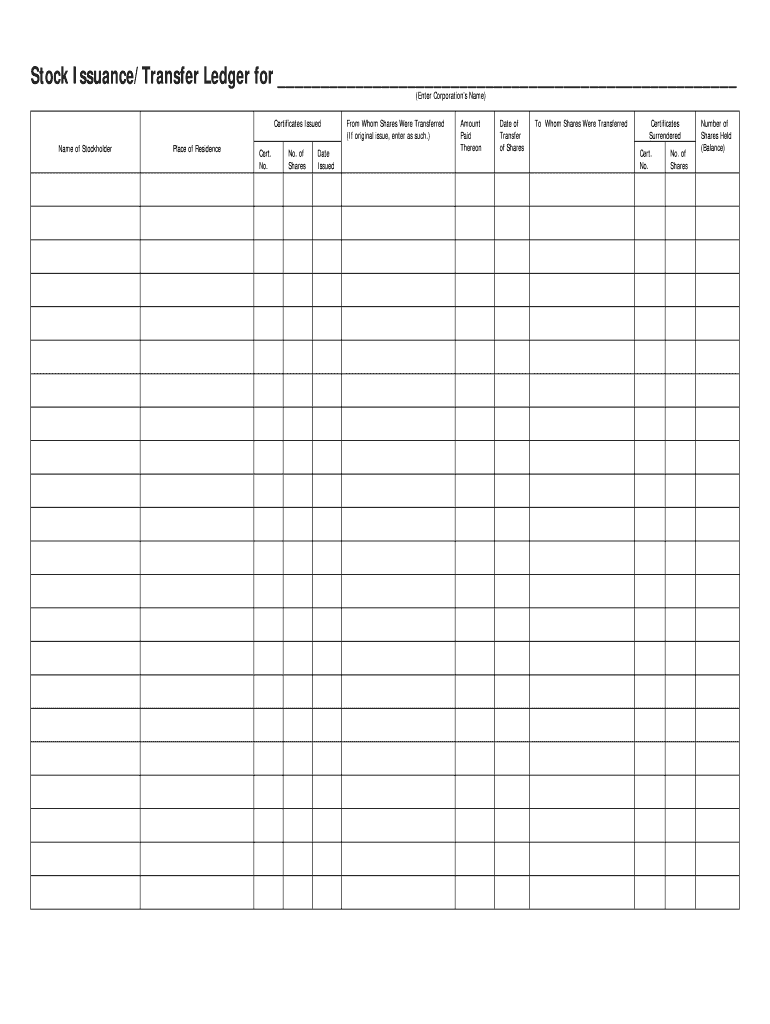

Who needs a transfer ledger?

One of the most important parts in the corporate document workflow is a stock issuance and transfer ledger. Accounting professionals use it to keep track of operations with company stock, keep in touch with shareholders, and calculate market capitalization.

What is this ledger for?

When a company needs to invite funds, it issues stock and sells it to the shareholders or to new investors. They can pay for a company share with money, equipment or real property. Also, stock can be transferred or re-purchased. All the stock transactions must be recorded in this ledger.

Is it accompanied by other forms?

In order to complete this ledger properly, shareholders and accounting departments must both present certificates of issuance or other transactions.

When is the transfer ledger due?

The stock issuance and transfer ledger is crucial to the large corporations, they would not be able to keep track of financial activity without it, which is why it does not have a due date.

How do I fill out a transfer ledger?

There is a table for transactions with columns to describe the specifics of every item. First, an accountant must write the name of a stockholder and his place of residence. Then there are three columns for issued certificates: certificate number, number of shares and date of issuance. One must write who transfers the shares and who obtains them. It’s important to provide the amount paid for the share transfer, date of the transaction, related certificates, and number of shares held.

Where do I send it?

This ledger belongs to the company and should be kept in a safe place at the bank or in the office.